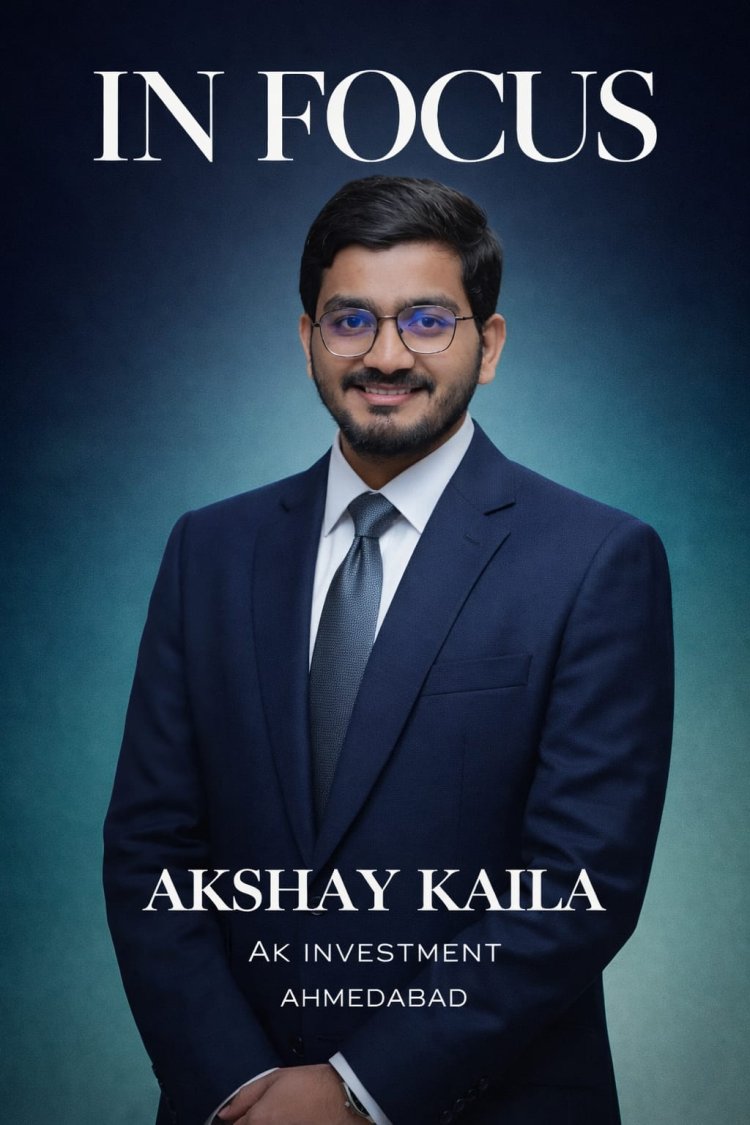

Akashay Kaila : Delivering Insight-Driven Equity Research with Integrity and Precision AK Investments

In an era where financial markets are more accessible than ever yet increasingly complex, investors seek more than just stock tips—they seek clarity, credibility, and conviction. At the forefront of this evolving landscape stands Akshay Kaila, the driving force behind AK Investment, Ahmedabad, a firm built on research excellence and regulatory integrity. As a SEBI Registered Research Analyst, Akshay Kaila has carved a niche in providing in-depth equity research services tailored to retail investors as well as High Net-Worth Individuals (HNIs), empowering them to make informed and confident investment decisions.

Based in Ahmedabad, AK Investment operates with a clear and focused mission: to bridge the information gap between market noise and meaningful insight. The firm specializes in detailed equity research, offering structured analysis that goes beyond surface-level recommendations. In a financial ecosystem often dominated by speculation and short-term sentiment, Akshay Kaila emphasizes disciplined research methodologies, data-backed strategies, and long-term value creation.

What distinguishes AK Investment is its commitment to analytical depth. Every research report is grounded in fundamental analysis, sectoral study, financial statement evaluation, and macroeconomic context. Rather than promoting impulsive trading behavior, the firm prioritizes understanding a company’s intrinsic value, growth trajectory, management quality, and risk profile. This approach ensures that clients are not merely reacting to market volatility but are investing with strategic foresight.

As a SEBI Registered Research Analyst, Akshay Kaila adheres strictly to regulatory standards, ensuring transparency, compliance, and ethical responsibility in every recommendation. In a market where credibility is paramount, regulatory registration provides clients with an added layer of trust. It signifies that the advisory services offered by AK Investment are not only professional but also accountable to established industry norms. This regulatory framework reinforces investor confidence and strengthens long-term relationships built on reliability.

Beyond research, AK Investment envisions expanding its role within the broader spectrum of investment advisory services. While its current focus remains on structured equity research and advisory, the firm is strategically laying the foundation to evolve into a comprehensive investment advisory platform. The long-term vision is to transition into a full-fledged Asset Management Company (AMC) in the coming years—an institution that not only advises but actively manages pooled capital through structured investment vehicles. This evolution will be guided by regulatory compliance, robust risk management systems, institutional-grade research processes, and a strong governance framework. By building capabilities gradually and responsibly, AK Investment aims to transform from a research-driven advisory firm into an integrated asset management institution that delivers professionally managed portfolios aligned with long-term wealth creation objectives.

AK Investment’s clientele includes both retail investors and HNI clients, each with distinct financial goals and risk appetites. Retail investors often seek guidance to navigate market complexities, identify quality opportunities, and avoid common pitfalls. Through structured research insights, AK Investment empowers them with knowledge that transforms uncertainty into clarity. For HNIs, the focus extends to customized equity strategies aligned with portfolio diversification, capital preservation, and sustainable wealth growth. By understanding each client’s objectives, the firm delivers recommendations that are both personalized and performance-oriented.

The foundation of AK Investment lies in a belief that informed investors are successful investors. Education and awareness form an integral part of the firm’s philosophy. Rather than encouraging blind adherence to advice, Akshay Kaila ensures that clients understand the rationale behind each recommendation. This collaborative approach not only enhances investor confidence but also fosters disciplined decision-making in volatile market conditions.

Operating from its office in Titanium Business Park, Ahmedabad, AK Investment has steadily built a reputation for consistency and professionalism. The firm’s structured processes, timely research dissemination, and systematic evaluation of market developments enable clients to stay ahead of trends without being overwhelmed by daily fluctuations. By filtering out noise and focusing on fundamental strength, AK Investment helps investors maintain perspective in both bullish and bearish cycles.

In today’s financial landscape, where information is abundant but insight is scarce, research-backed advisory services have become indispensable. Akshay Kaila recognizes that equity markets reward patience, prudence, and preparation. His analytical framework combines quantitative evaluation with qualitative assessment, ensuring that investment decisions are balanced and comprehensive. This blend of discipline and diligence has positioned AK Investment as a trusted partner for investors seeking long-term value rather than short-term excitement.

Moreover, AK Investment embodies the entrepreneurial spirit of Ahmedabad’s dynamic financial ecosystem. The city has emerged as a vibrant hub for business and capital markets, and the firm contributes to this ecosystem by elevating research standards and investor awareness. Through ethical advisory practices and client-centric service, Akshay Kaila continues to strengthen the region’s investment community.

As markets evolve with technological advancements, global interconnectivity, and regulatory reforms, the need for credible research advisors will only grow. AK Investment stands prepared to meet this demand with unwavering commitment to transparency, depth, and integrity. With a forward-looking roadmap that includes scaling advisory capabilities and ultimately establishing itself as a regulated Asset Management Company, the firm is positioning itself for sustainable institutional growth. For investors looking to navigate equities with confidence, Akshay Kaila offers more than recommendations—he offers a structured path toward informed wealth creation.

In a world of rapid market movements and conflicting opinions, AK Investment remains anchored in research, responsibility, and results. Under the leadership of Akshay Kaila, the firm exemplifies how disciplined analysis and ethical advisory can transform investment journeys. For clients across retail and HNI segments, AK Investment is not merely a financial advisory service—it is a partner in building sustainable financial futures.

To know more about us, please visit our website :

What's Your Reaction?